Follow the Money in Five Easy Steps

ONE WORLD ECONOMY

Our nanna told us that “a penny saved is a penny earned” but I doubt that now. A dollar saved is a dollar not spent. It just sits the moneybox doing nothing. Only spending gets money circulating and only in circulation can money generate production and value.

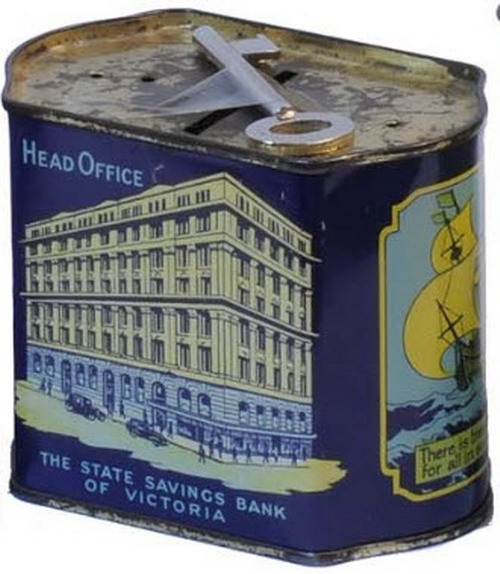

TWO MONEYBOXES

When I was a kid I had two money boxes. One was rather racist, in keeping with the times - a cast iron gollywog. You put a penny in his outstretched hand and flipped a lever and he swallowed the coin. Our grandfather, born in the 19th Century, gave us one each and then slipped us a penny every time he visited. I’ll admit my sister and I loved it.

When the gollywog was full mum would unscrew the back and we’d transfer the coins to a State Bank tin, shaped like the Bank’s headquarters in the city.

When that was full we’d walk up the street to the local State Bank branch and hand the money to the man over the counter. My pale blue passbook had an official seal with the lion and the unicorn, and the words “Guaranteed by the Government of Victoria.” I remember asking mum what “guaranteed” meant and she said we could always get the money back if we needed to spend it, which I often did on bows and arrows and cowboy guns and later on comics. But of course it actually stayed there for years until I left home and found there was more in the account than I remembered, and was pretty pleased with myself when I bought a motor bike.

And so I grew up believing that banks were friendly places that helped you save, looked after your money, and paid it back with interest. Many years later I went to that same bank to get a home loan for our first weatherboard house. Because this was a public institution that I believed I could trust. It took another forty years for me to see the true character of modern day banks and to finally realise how duped we were when Joan Kirner sold our State Savings Bank to the Commonwealth Bank so Hawke and Keating could privatise it.

Maybe I’m too trusting, a slow learner. Over the years that trust has evaporated and a harder-edged sense of politics now moulds my ideas.

I grew up with some racist ideas too, which I gradually came to regret and change. But I’ve kept the gollywog out of nostalgia. It wasn’t his fault, nor mine. As workers and consumers we are all just products of our times.

Lately I’ve been reading “The Production of Money” by Ann Pettifor which helps me frame banking and modern money systems, which in their turn are major producers of this, the financialised and globalised era of capital. The following is not so much a review of that book as a rolling reflection on the first few chapters.

THREE REVELATIONS

A common view is that banks act as middle men between savers and lenders - storing all those pennies from the nation’s piggy banks and lending them out to investors and entrepreneurs who then make a profit so the repayments return to us as interest on our savings accounts. Nothing could be further from the truth, although it had some validity back in the gollywog days.

Another misconception, or myth, or even perhaps a lie is that the banks have minimum reserves to keep them safe. This is sometimes called the money multiplier or fractional banking - that governments ensure banks have enough cash stashed away (10% say) to cover them when they make loans, if the loans go bad.

It’s true the main commercial banks have accounts with the national Central Bank but these accounts are mainly used to settle inter-bank payments by computer entries - debiting and crediting payments so the system is balanced. There are no “reserves” involved. There is no cash involved either. There are also various prudential and risk management measures in place but, as the GFC showed, these are inadequate and governments had to step in to protect the banks that were supposedly “too big to fail.”

Ann Pettifor clarifies these confusions in her book The Production of Money, in fact she blows such fallacies out of the water. In Chapter 2 she records how Ben Bernanke, then Governor of the US Federal Reserve, described on TV the bail out of a major insurance company to the tune of $85 billion dollars, not with taxpayer funds nor financed by government “debt,” rather, he explained, “we simply mark up their account by computer entry!”

This money did not “come from” anywhere, it was created, invented, conjured out of thin air. On the 13 March 2009 that $85bn did not exist, on 14 March it sat as a line item in the insurance company’s Federal Reserve account. On 15 March the Governor of the Fed explained it’s appearance on the CBS show 60 Minutes. The same day they started spending it to pay down debt and shore up assets so they would not follow Lehman’s investment bank into oblivion.

This was a great revelation to me because you never see stuff like that in the finance reports on mainstream media. But there’s more. The Bank of England described modern money creation in a Quarterly Bulletin back in 2014. Although not widely known amongst ordinary people, commercial banks create money out of thin air whenever they issue a loan. Bank loans (housing, commercial, investment, personal, cars and so on) create 95-97% of the money in circulation! Oh yes, the government creates only 3% or in some cases five. So one day there’s not enough money and the next there might be too much. It’s unregulated and almost entirely in private hands, under private control.

A third, similar revelation came from Germany’s Bundesbank in its April 2017 Monthly Report - explicitly stating that banks are not intermediaries, transferring money from savers to investors, but rather creators of money.

Once these revelations about the nature of money started to sink in, my disbelief switched to “how come we didn’t know this?” I discovered that the Bundesbank had

previously laid it all out in 2010, in a publication entitled "Money and Monetary Policy" (pages 88-93). I found a quote from the Right Honourable Reginald McKenna dating

from 1924 - “Every loan, overdraft, or bank purchase creates a deposit, and every repayment of a loan, overdraft, or bank sale destroys a deposit.” He was a

former British Chancellor of the Exchequer and Chairman of the Midland Bank (quoted on the Sensible Money website, which includes a clear video explanation).

I also found a host of blogs and “serious” websites discussing these very issues - Prime Economics, Positive Money, Sensible Money, the New Economics Foundation. You can

google them all in a quiet moment.

According to Pettifor none of this is new, nor really revelatory if you’d been following the money. Keynes explained it in his General Theory of Employment Interest and Money, and long before him the Scottish political economist John Law did too. She lists a number of other monetary theorists including Schumpeter, Galbraith and Minsky who all saw that, in a nutshell, there is no money in the bank before the borrower applies for a loan, and that the system runs on credit. And credit, of course, is another word for debt.

FOUR CENTRAL BANKS

Modern states have “central” banks to control the nation’s money supply, manage inflation and interest rates, and settle inter-bank payments. Privately owned until World War 2, most are now in public hands though supposedly “independent” of government control.

The archetypal Bank of England was founded in 1694, following the Dutch and Italian model. It’s original remit was to provide credit to the British Crown and so free them from the “robber barons” who had been the only source of loans - drawing wealth from land, peasant labour, corn, gold and so on. This borrowing, especially to finance the wars against France, came at such high interest that immense taxation was required to repay it. From the start the BoE simply created money because it “never professed to make its issues square exactly with its coin and bullion.” Originally a private bank, it was nationalised in the Keynesian heyday, 1946, forming a fascinating mirror to its foundation date.

Its website says it’s purpose is to promote “the good of the people of the United Kingdom by maintaining monetary and financial stability.” It’s one of the main central Banks in the world, along with US Federal Reserve, the Bank of Japan and the European Central Bank. Australia’s Reserve Bank is also up there in the top eight. Interestingly our Reserve says on its website that it has three core purposes - the stability of the currency, maintaining full employment, and contributing to the economic prosperity and welfare of the Australian people. What we see in the Australian case is an almost total focus on the first purpose - which boils down to managing inflation - and a complete disregard for full employment and the prosperity/welfare of the Australian people.

All four of these Central Banks have the power to create money themselves, and to control how the commercial banks (their customers) create that other 95%. The big four, though not Australia, have tried this mainly through the mechanism of Quantitative Easing (QE) where they conjure up new money electronically to buy financial assets from the commercial banks. Often this is redemption of government bonds, thus restraining the current government debt and injecting electronic cash into the financial sector. The theory is that the latter will in turn loan to productive investors to get the economy moving again.

Except it hasn’t got moving, not in Japan, not in Europe and only very slightly in the USA. The banks have pocketed the new money, paid down debts, cleaned up balance sheets, and bought their own “fictional” assets to hedge their bets, like share portfolios and even gold. Nothing productive about QE.

Although all modern Central Banks have a stated mission to serve the citizens of their respective countries, the biggest of them (the US Federal Reserve) is actually owned by the big commercial banks it supposedly oversees. And a quick look at the board members of our Reserve Bank (under public ownership) shows a bunch of company directors but no pensioners, unionists or workers. Six older white men and three white women.

How does all this happen and yet most people, most voters, have no idea about it? How has the finance sector become the master rather than the servant of the productive economy? How is it that the Central Banks, including our Reserve Bank, ignore employment and focus almost exclusively on money supply?

Pettifor’s thesis, similar to that of Steve Keen and many other heterodox macro-economists, is that the economics profession has been captured by neoclassical thinking - austerity, micro-economic focus, balanced government budgets, chasing a utopian myth of supply: demand equilibrium, and so on. She points out that these “flawed, ideological theories and models” are a great comfort to financial elites, and quotes Satyajit Das from his book Traders, Guns and Money:

“Modern finance is generally incomprehensible to ordinary men and women ... The level of comprehension of many bankers and regulators is not significantly higher... It was probably designed that way. Like the wolf in the fairy tale: All the better to fleece you with.”

Steve Keen, in his Debunking Economics, demolishes the validity of those neoclassical assumptions that underpin mainstream economics, the ideology behind unfettered free markets, commercial banking, the finance sector, all government departments and university courses. He shows in detail how they lack empirical support and produce neither efficiency nor equity for the majority of people. He describes neoclassical economics as a “degenerative” research program, generating no new knowledge but shielding its core beliefs from critique. Himself a Professor of Economics, he states baldly that “Economics is too important to leave to the economists.”

In the second half of The Production of Money Ann Pettifor puts forward a political program, based on Keynes’s work before and at the 1944 Bretton Woods conference, aimed at reigning in the immense power of commercial banks. Her central point is summed up by the phrase “make finance capital the servant rather than the master of the productive economy.”

Hers is not a revolutionary program, she does not seek to overthrow capitalism. Rather to smooth it out, make the “business cycles” less disruptive and hence more efficient. With the corollary of greater transparency and justice for ordinary people and the chance of saving the planet from resource depletion, pollution and abrupt climate change. Pettifor’s attitude could be described as socially democratic.

G20 protestors act as zombies - the consumers and victims of financialised capitalism

FIVE POSSIBILITIES

Although the big banks, and to a lesser extent the Central Banks, create money at the flick of a computer keystroke, we must bear in mind is that credit money is not the same as “VALUE.” They are creating credit/debt which must be invested in productive industry before it can be realised (made real) as wealth and value. All too often this phantom credit is going into share buybacks, CEO salaries, housing bubbles and the like. Could this be turned around? Are there alternatives?

Ann Pettifor thinks so, and while I won’t go into the detail she provides in the latter part of her book, it’s fascinating to imagine a better world based on her ideas. For example:

- If the big banks were brought under democratic control and to some degree of public ownership, then the stated goals of full employment and national prosperity (a common wealth) could be pursued, rather than the current endless greed of high interest rates and investment bubbles. Finance could again assume the role of public service.

- QE could be put to productive use instead of lining the pockets of hotshots in the finance industry. QE funds could be used for socially productive purposes such as reforesting the plains, cleaning up rivers and creeks and wetlands, building wind farms and tidal generators, installing PV panels on all domestic properties, funding schools and TAFE, establishing free medical clinics across the country. And so on.

- If the Commonwealth issued money rather than allowing the private sector to monopolise the process, the Job Guarantee favoured by Modern Money Theory could be established leading to basically full employment. All those who wanted to work could do so.

- A renationalised CBA - Australia’s previously government-owned bank - could issue loans at a low interest rate (essentially enough to cover inflation) that would force the commercial banks into a truly competitive environment. Interest rates could be brought down for small business across the board. More innovation, lower costs, higher employment.

- Keynes reportedly said - “above all, let finance be primarily national” (quoted in The Perils of Free Trade by Herman E Daly) - and Pettifor builds upon this notion an extensive rewinding of globalisation. Her intent is to regain national political autonomy from the international financial institutions. That entails re-establishing capital controls to restrain and regulate capital flows across the world, presently conducted in the blink of the eye via the internet. “We need to reform and adjust monetary policy. We need to bring offshore capitalism back onshore” (page 159).She knows that national governments will not tackle such politics and calls on “people” to lead, especially women and environmentalists. She is not starry eyed.

Hmmm, an ambitious political program. Maybe she is a revolutionary after all?

Further Reading

- Ann Pettifor, The Production of Money, Verso, 2017

- Steve Keen, Debunking Economics, Zed Books, 2011

- Herman E Daly, The Perils of Free Trade, Scientific American, November 1993

- Ann Pettifor, The Power to Create Money Out of Thin Air: A review essay of Geoffrey Ingham’s Capitalism from - Prime Economics

- Ann Pettifor - Lecure at the London School of Economics

- Positive Money: How Banks Create Money

- Sensible Money - Where does money come from?

- Reginald McKenna quoted in Sensible Money

- Reserve Bank of Australia about the Board

- Francesco Defila The Bank of England changed everything

- BoE Quarterly Bulletin: Money creation in the modern economy

- Zeta online discussion: Fallacy of Fractional Reserve Banking

- Bundesbank Admits that Credit is Created out of Thin Air quoted in online blog

- Norbert Haring, Bundesbank rejects 100% money, Real World Economics Review, May 16, 2017

Published July 2017

Like this article? Share it on Twitter . . . Share on Twitter